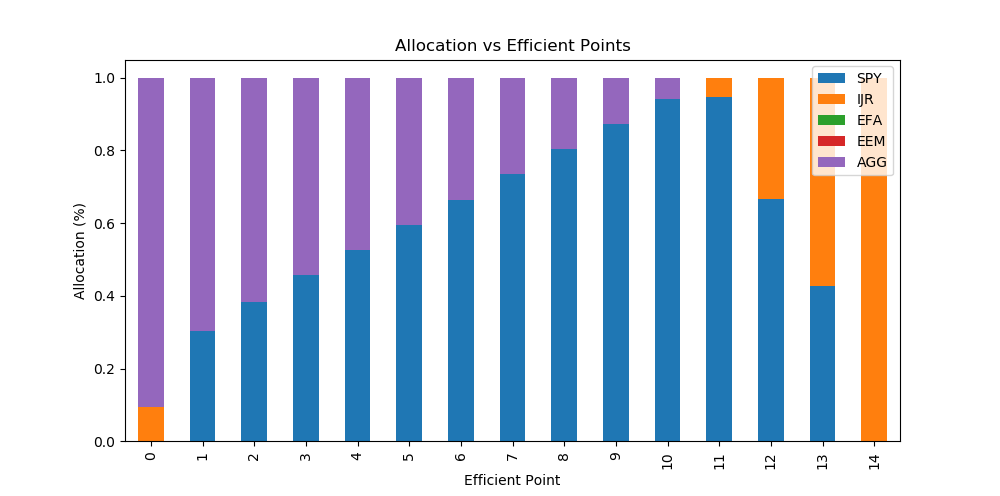

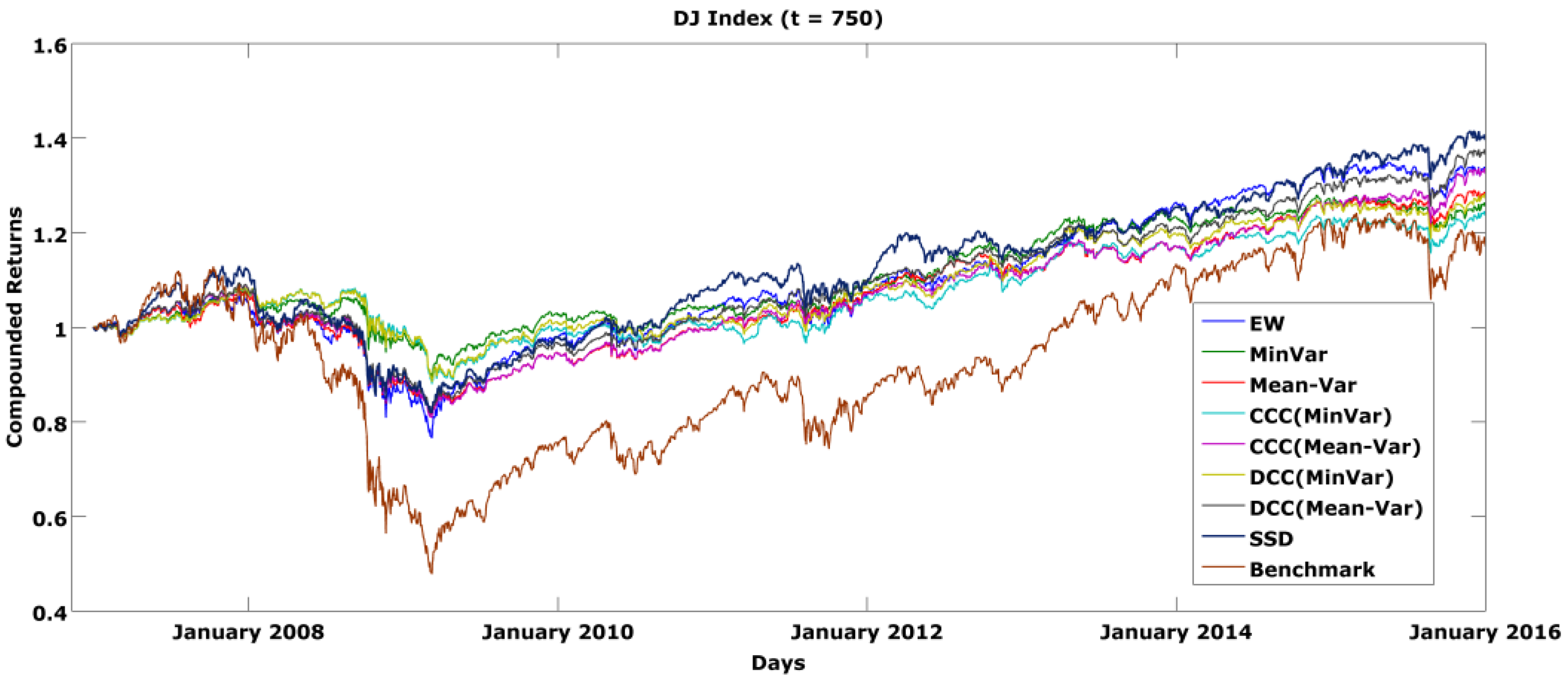

JRFM | Free Full-Text | Portfolios Dominating Indices: Optimization with Second-Order Stochastic Dominance Constraints vs. Minimum and Mean Variance Portfolios

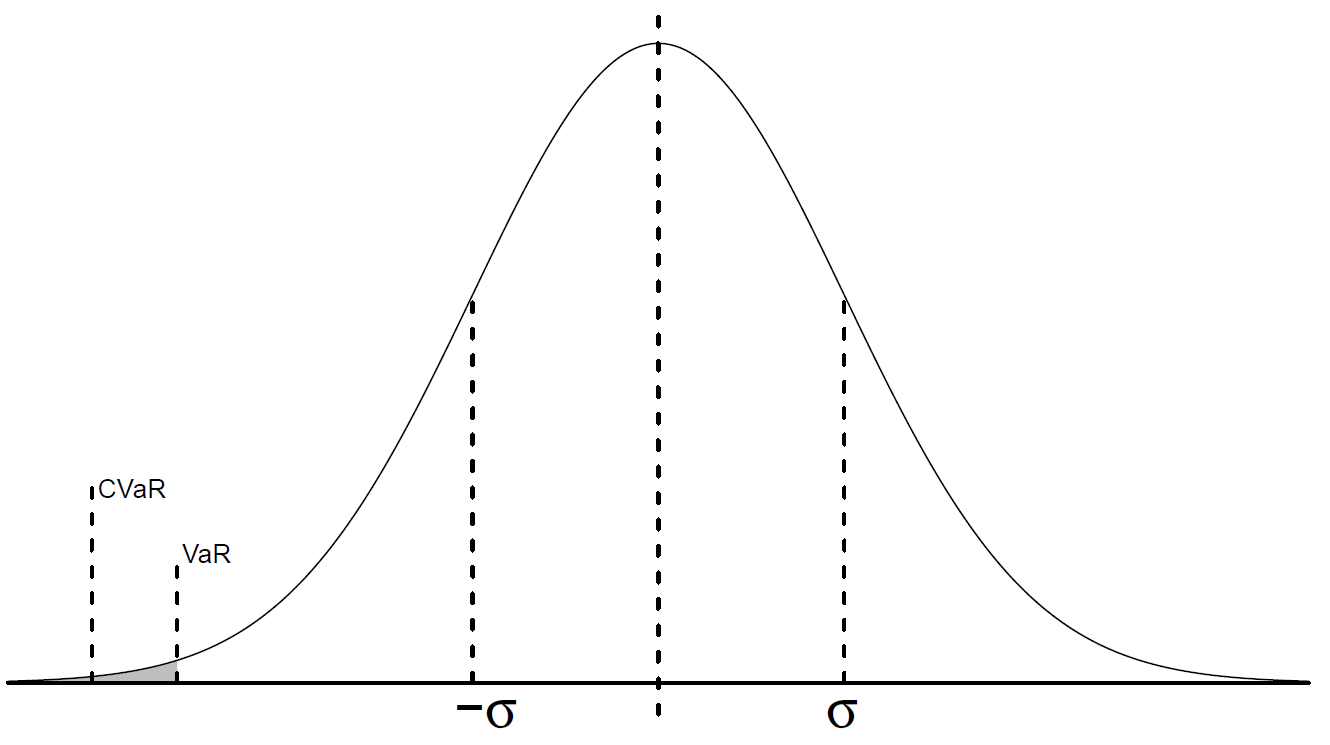

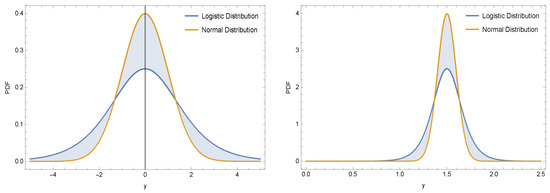

Mathematics | Free Full-Text | Interactions of Logistic Distribution to Credit Valuation Adjustment: A Study on the Associated Expected Exposure and the Conditional Value at Risk

Out-of-sample downside risks from (SSD), (RSSD) (for λ = 0.2), (MM),... | Download Scientific Diagram